what is the tax rate in tulsa ok

Mustang OK Sales Tax Rate. 4 rows The current total local sales tax rate in Tulsa OK is 8517.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Nearby homes similar to 4548 E 45th St S have recently sold between 160K to 248K at an average of 150 per square foot.

. State of Oklahoma 45. How much is tax by the dollar in Tulsa Oklahoma. The 8517 sales tax rate in tulsa consists of 45 oklahoma state sales tax 0367 tulsa county sales tax and 365 tulsa tax.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Norman OK Sales Tax Rate. Inside the City limits of Tulsa the Sales tax and Use tax is.

The 8517 sales tax rate in Tulsa consists. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022. Learn all about Tulsa real estate tax.

Yearly median tax in Tulsa County. The Oklahoma state sales tax rate is currently. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

Whether you are already a resident or just considering moving to Tulsa to live or invest in real estate estimate local property tax rates and learn how. Depending on local municipalities the total tax rate can be as high as 115. Oklahoma has numerous local governmental entities including counties and special districts such as public.

State of Oklahoma 45 Tulsa County 0367 City. This is the total of state county and city sales tax rates. Tulsa County 0367.

State of Oklahoma 45 Tulsa County 0367 City. Tulsa County collects on average. 160000 Last Sold Price.

Owasso OK Sales Tax Rate. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Tax rate of 075 on taxable income between 2001 and.

The current total local sales tax rate in Tulsa OK is 8517. Oklahoma City OK Sales Tax Rate. Tulsa Sales Tax Rates for 2022.

Tax rate of 025 on the first 2000 of taxable income. SOLD MAY 13 2022. The December 2020 total local sales tax rate was also 4867.

The current total local sales tax rate in Tulsa County OK is 4867. For the 2020 tax year Oklahomas top income tax rate is 5. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

4 rows 2483 lower than the maximum sales tax in OK. Tulsa OK Sales Tax Rate. Detailed Oklahoma state income tax rates and brackets are available on this page.

For married taxpayers living and working in the state of Oklahoma. The median property tax also known as real estate tax in Tulsa County is based on a median home value of and a median effective property tax rate of 106 of. Tulsa County OK Sales Tax Rate.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma.

2000 on the 1st 150000 of. The Oklahoma sales tax rate is currently. In principle tax receipts should be same as the amount of all yearly funding.

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The current total local sales tax rate in Oklahoma City OK is 8625.

Ponca City OK Sales Tax. The December 2020 total local sales tax rate was also 8517. Oklahoma sales tax details The Oklahoma OK state sales tax rate is currently 45.

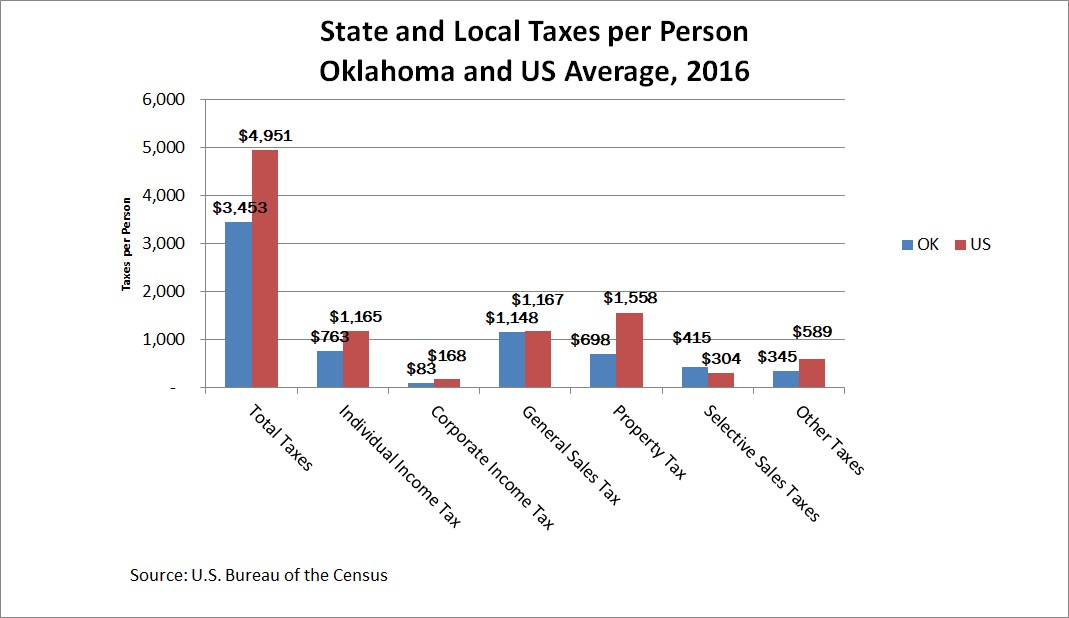

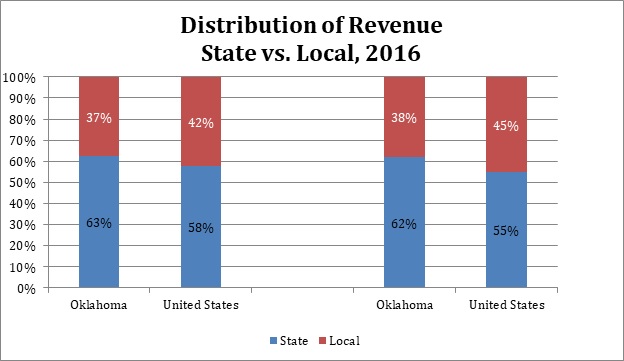

How Oklahoma Taxes Compare Oklahoma Policy Institute

House Will Study Virtual Charter Schools Charter School Virtual School Study

Taxes Broken Arrow Ok Economic Development

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

The Mathematics Of Inequality Bruce Boghosian Runs The Numbers And Shows That Without Redistribution Of Wealth The Rich Inequality Mathematics Economic Model

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Individual Income Tax Oklahoma Policy Institute

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Ryan Aispuro Said Epic Terminated Her Employment Because She Resisted Pressure To Manipulate Epic S Truancy Standards Charter School School Fund Epic

Total Sales Tax Per Dollar By City Oklahoma Watch

The Impact Of The Coverage Gap For Adults In States Not Expanding Medicaid By Race And Ethnicity Kff Medicaid Family Foundations Participation Rate

Oklahoma Sales Tax Small Business Guide Truic

State And Local Tax Distribution Oklahoma Policy Institute

We Have Better Options Than A Costly And Poorly Targeted Income Tax Cut Oklahoma Policy Institute

Famous Gushers Of The World World Water Well Drilling Oil And Gas